Homework #5

Ming Chen & Wenqiang Feng

2/2/2017

You can also get the PDF format of Wenqiang’s Homework.

Exercise 6.44

- (a). What are the populations of interest?

- The plants of tobacco treated with two different fumigants

- The variable being studies is the number of parasites from the plants

- (b). Yes. The p-value is 2.089e-05, which is a strong evidence to indicate a difference in the mean level of parasites for the two fumigants.

F1 = c(77,40,11,31,28,50,53,26,33)

F2 = c(76,38,10,29,27,48,51,24,32)

t.test(F1, F2, paired = T, conf.level = 0.90)##

## Paired t-test

##

## data: F1 and F2

## t = 8.8544, df = 8, p-value = 2.089e-05

## alternative hypothesis: true difference in means is not equal to 0

## 90 percent confidence interval:

## 1.228866 1.882245

## sample estimates:

## mean of the differences

## 1.555556- (c). the size of diference = 1.555556, 90% CI = [1.228866, 1.882245]

Exercise 6.46

abundance = c(5124,2904,3600,2880,2578,4146,1048,1336,394,7370,6762,744,1874,

3228,2032,3256,3816,2438,4897,1346,1676,2008,2224,1234,1598,2182)

depth = c(rep(40, 13), rep(100, 13))

oil_traj = c(rep(c("within", "outside"), c(7,6)),

rep(c("within", "outside"), c(7,6)))

pop_abundance = data.frame(abundance, as.factor(depth), oil_traj)library(dplyr)##

## Attaching package: 'dplyr'## The following object is masked from 'package:gridExtra':

##

## combine## The following object is masked from 'package:MASS':

##

## select## The following objects are masked from 'package:plyr':

##

## arrange, count, desc, failwith, id, mutate, rename, summarise,

## summarize## The following objects are masked from 'package:stats':

##

## filter, lag## The following objects are masked from 'package:base':

##

## intersect, setdiff, setequal, unionwithin = filter(pop_abundance, oil_traj=='within')$abundance

outside = filter(pop_abundance, oil_traj=='outside')$abundanceExercise 6.46 (a)

- Since the variances between the two groups are very different, we use the separate variance t-test.

- \(Var_{within}\) =

var(within)= 1.419065210^{6} - \(Var_{outside}\) =

var(outside)= 4.966544310^{6}

- \(Var_{within}\) =

- separate variance t-test

- \(H_{0}: \mu_{within} = \mu_{outside}\) vs. \(H_{a}: \mu_{within} \neq \mu_{outside}\)

- P-value = 0.384 > 0.05, fail to rejct the \(H_{0}\)

- Conclusion: no sufficient evidence to indicate a difference in average population abundance

t.test(within, outside, var.equal = FALSE)##

## Welch Two Sample t-test

##

## data: within and outside

## t = 0.89466, df = 16.224, p-value = 0.384

## alternative hypothesis: true difference in means is not equal to 0

## 95 percent confidence interval:

## -877.7749 2162.1558

## sample estimates:

## mean of x mean of y

## 3092.357 2450.167Exercise 6.46 (b)

- Size of the difference: 0

- 95% CI: [-877.7749, 2162.1558]

Exercise 6.46 (c)

- Required conditions:

- independent samples

- two samples are approximately normally distributed

Exercise 6.46 (d)

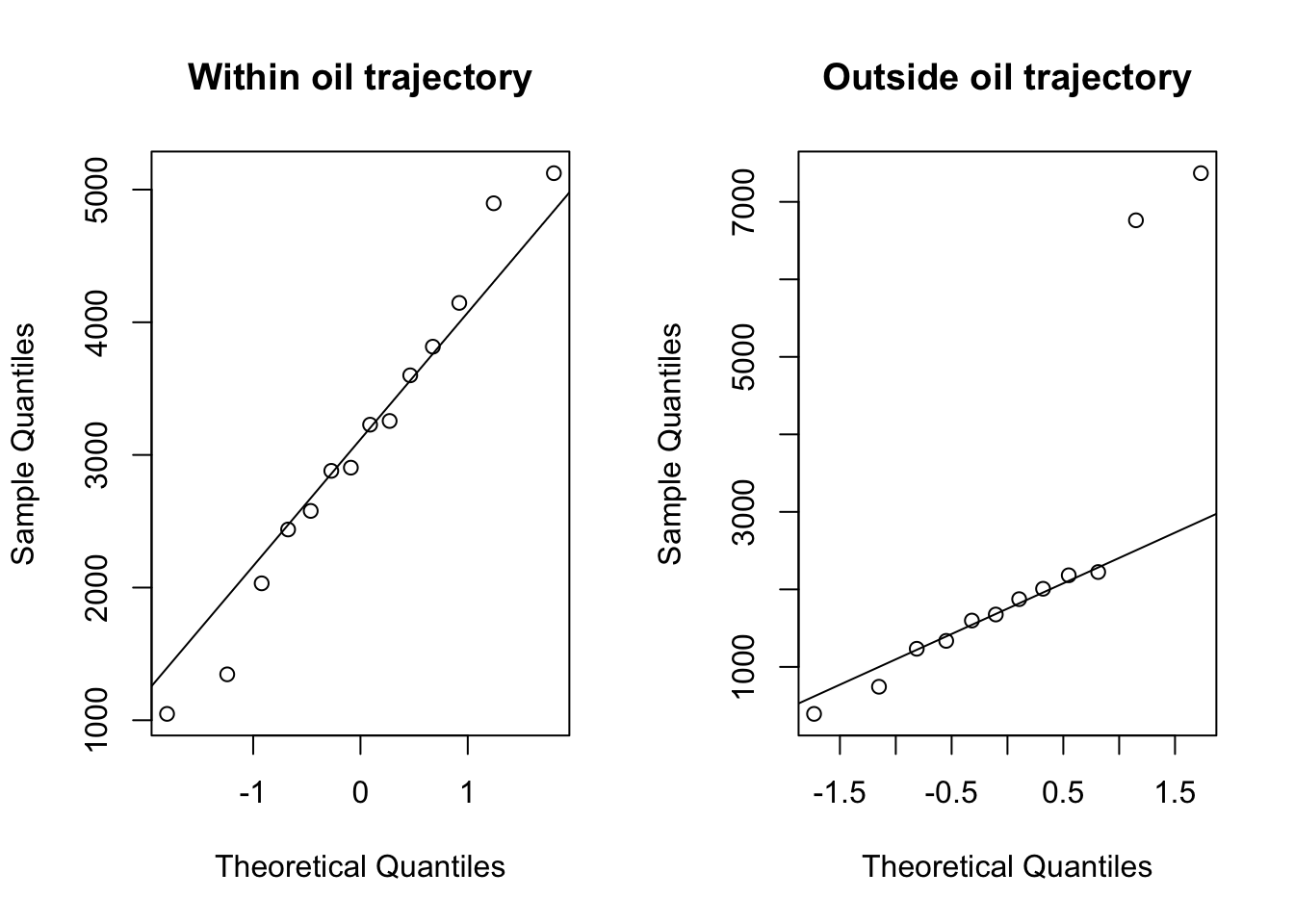

- QQ plot shows that

- the data from the within oil trajectory appears normally distributed

- the data from the outside oil trajectory is not normally distributed

par(mfcol=c(1,2))

qqnorm(within, main="Within oil trajectory")

qqline(within)

qqnorm(outside, main="Outside oil trajectory")

qqline(outside)

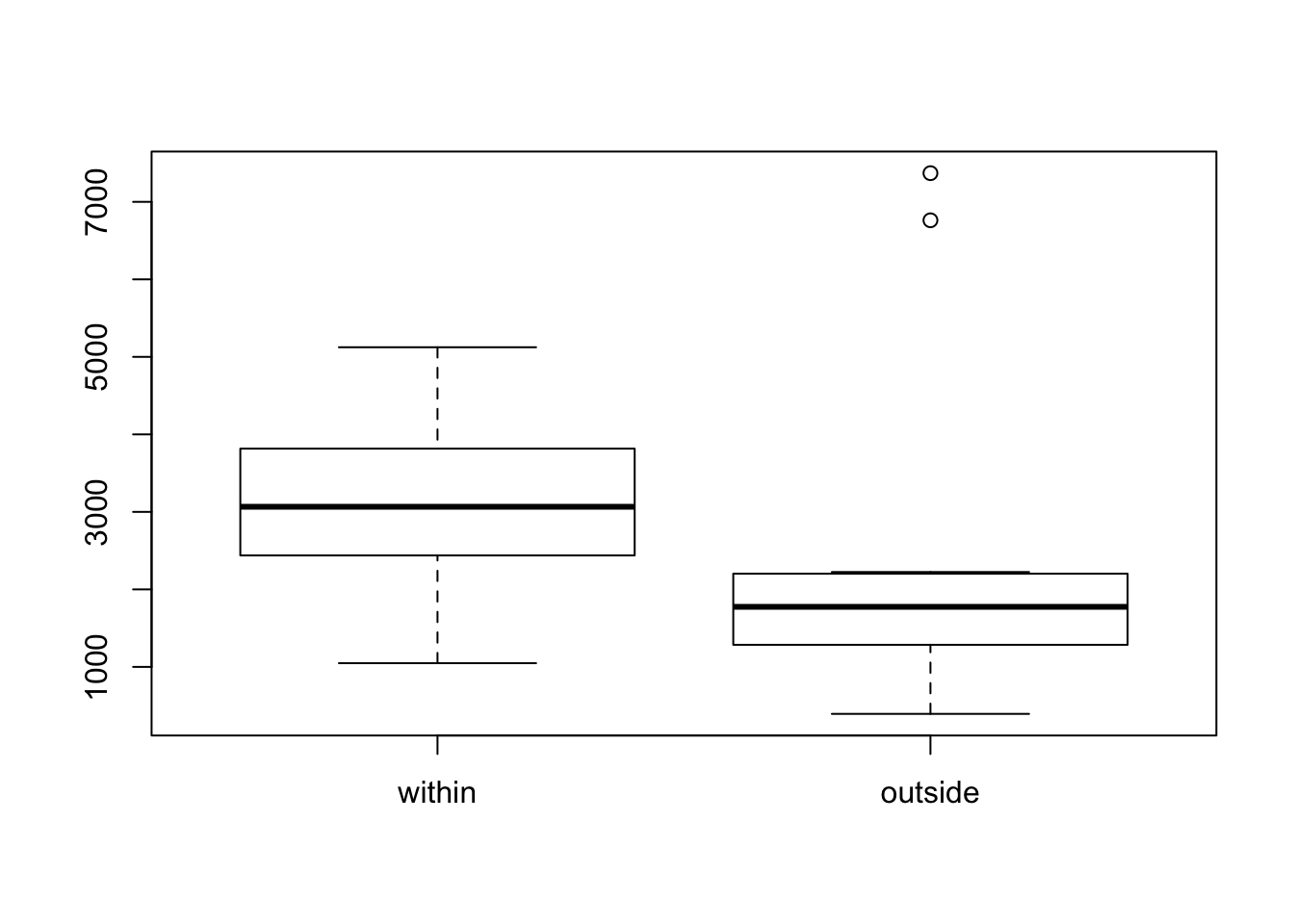

- Unequal variance

- The two samples have unequal variances

- Outside oil trajectory data has larger variance

par(mfcol=c(1,1))

boxplot(within, outside, names=c("within", "outside"))

Exercise 7.25(a)

- Data input

portfolio1 = c(130,135,135,131,129,135,126,136,127,132)

portfolio2 = c(154,144,147,150,155,153,149,139,140,141)

sd(portfolio1)^2## [1] 12.93333- Levene test

- The p-value = 0.07724 > 0.05 from the levene test below indicates that we failed to reject the \(H_{0}\) hypothesis. There is no strong evidence to support that portfolio 2 has higher risk than portfolio 1.

library(car)##

## Attaching package: 'car'## The following object is masked from 'package:dplyr':

##

## recode## The following objects are masked from 'package:HH':

##

## logit, vifdt = data.frame(y=c(portfolio1, portfolio2),

group=rep(c("1", "2"), c(length(portfolio1), length(portfolio2))))

leveneTest(y~group, dt)## Levene's Test for Homogeneity of Variance (center = median)

## Df F value Pr(>F)

## group 1 3.5122 0.07724 .

## 18

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Exercise 7.26

- Tests for two population variances

- $H_{0}: two variances are eqaul vs. H_{a}: two varainces are not equal

- P-value = 0.1485 > 0.05, fail to rejct \(H_{O}\).

- Conclusion: the two variances are equal

var.test(portfolio1, portfolio2)##

## F test to compare two variances

##

## data: portfolio1 and portfolio2

## F = 0.36421, num df = 9, denom df = 9, p-value = 0.1485

## alternative hypothesis: true ratio of variances is not equal to 1

## 95 percent confidence interval:

## 0.09046343 1.46628824

## sample estimates:

## ratio of variances

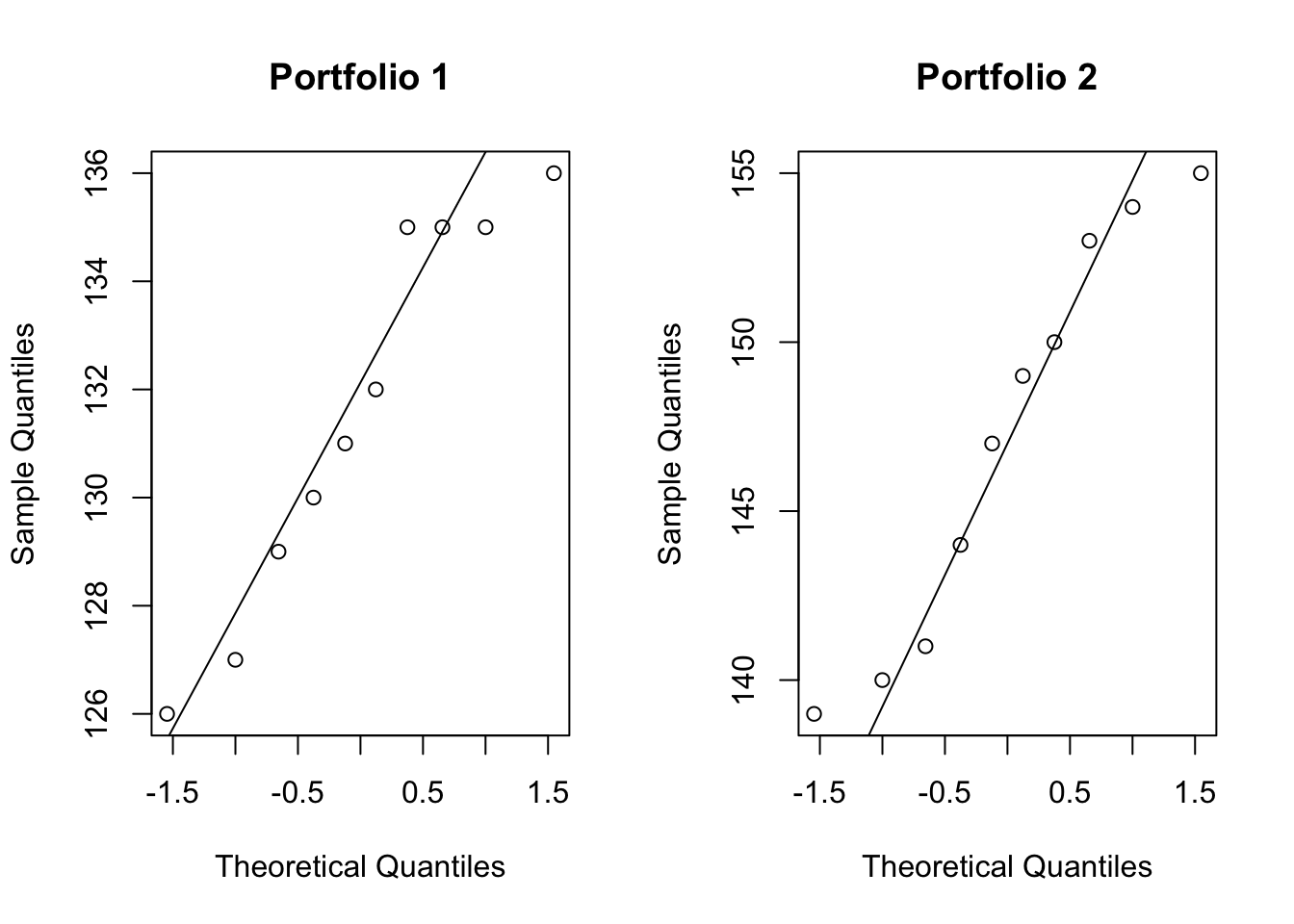

## 0.3642053- Tests for normality

- QQ plots show that the two samples are approximately normally distributed.

par(mfcol=c(1,2))

qqnorm(portfolio1, main = "Portfolio 1")

qqline(portfolio1)

qqnorm(portfolio2, main = "Portfolio 2")

qqline(portfolio2)

par(mfcol=c(1,1))Since the two samples are randomly selected, normally distributed and have equal variance, I choose the pooled variance t-test to detect if there is any differences in the average returns for the two portfolios.

- \(H_{0}: \mu_{1} = \mu_{2}\) vs. \(H_{a}: \mu_{1} \neq \mu_{2}\)

- P-value = 1.314e-06 < 0.0001, reject \(H_{0}\)

- Conclusion: there is strong evidence that a difference in the mean returns of the two portfolios exits.

t.test(portfolio1, portfolio2, var.equal = T)##

## Two Sample t-test

##

## data: portfolio1 and portfolio2

## t = -7.0877, df = 18, p-value = 1.314e-06

## alternative hypothesis: true difference in means is not equal to 0

## 95 percent confidence interval:

## -20.22415 -10.97585

## sample estimates:

## mean of x mean of y

## 131.6 147.2