Homework #1

Ming Chen & Wenqiang Feng

2/2/2017

1. Problem 1.22

Load data

data122 <- read.table("./data/CH01PR22.txt", col.names = c("y", "x"))a. Obtain the estimated regression function

fit <- lm(y~x, data=data122)

summary(fit)##

## Call:

## lm(formula = y ~ x, data = data122)

##

## Residuals:

## Min 1Q Median 3Q Max

## -5.1500 -2.2188 0.1625 2.6875 5.5750

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 168.60000 2.65702 63.45 < 2e-16 ***

## x 2.03438 0.09039 22.51 2.16e-12 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 3.234 on 14 degrees of freedom

## Multiple R-squared: 0.9731, Adjusted R-squared: 0.9712

## F-statistic: 506.5 on 1 and 14 DF, p-value: 2.159e-12Regression function

(C <-coef(fit))## (Intercept) x

## 168.600000 2.034375beta0 <- C[1]; beta1 <- C[2]

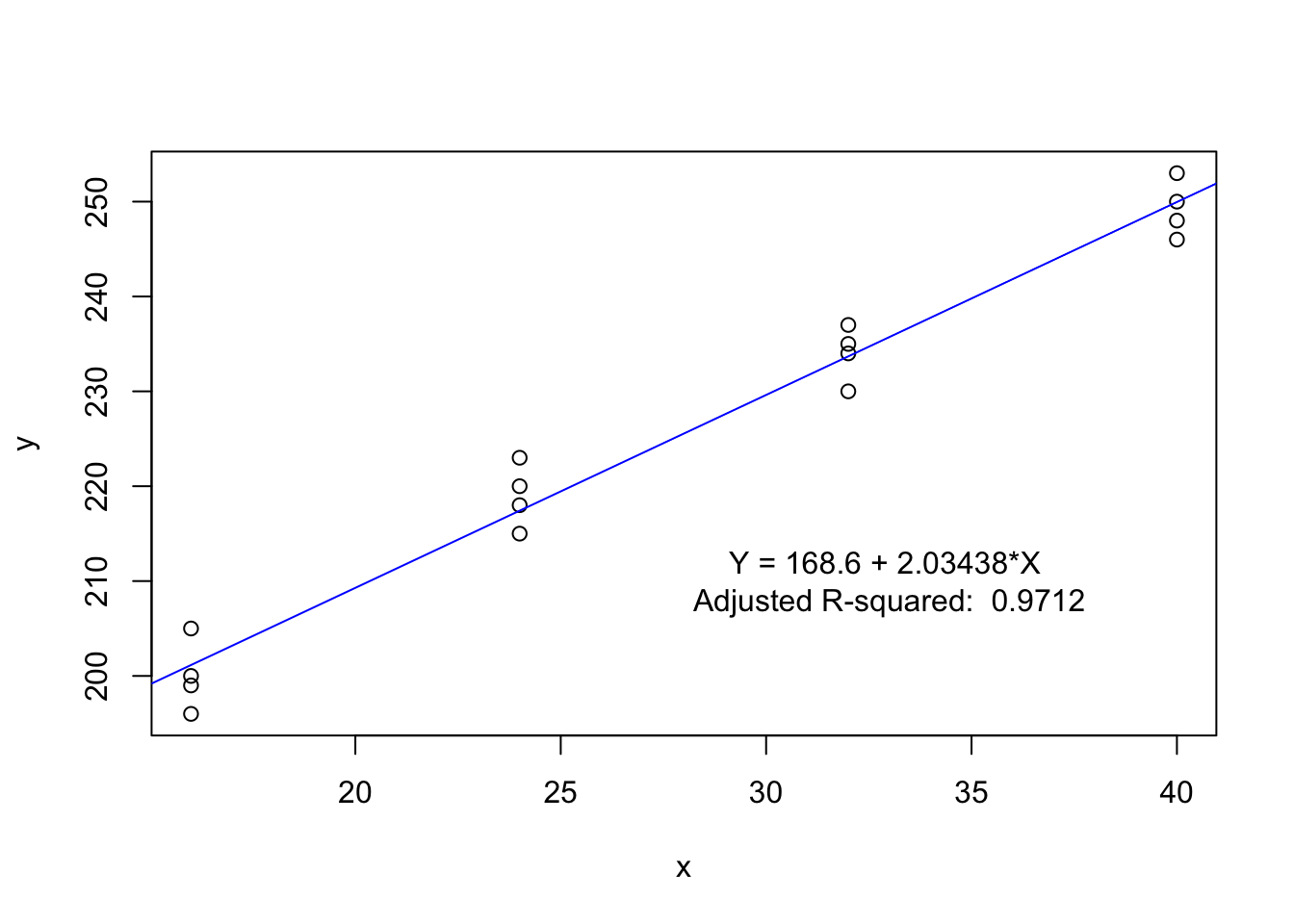

substitute(y<-beta0+beta1*x, list(beta0=beta0, beta1=beta1))## y <- 168.6 + 2.034375 * xHence the regression function is: \[ y= 168.6 + 2.034375X .\]

Plot the regression function and the data

plot(y~x, data = data122)

abline(coefficients(fit), col="blue")

text_label = substitute(y<-beta0+beta1*x, list(beta0=beta0, beta1=beta1))

text(33, 210, "Y = 168.6 + 2.03438*X \nAdjusted R-squared: 0.9712")

Based on the fitted results, we may conclude that the linear regression gives a good fit.

b. Obtain a point estimate of the mean hardness when X = 40 hours

X40 <- predict.lm(fit, data.frame(x=40))

X40## 1

## 249.975The estimated value at \(x=40\) is \(249.975\).

c. Obtain a point estimate of the change in mean hardness when X increases by 1 hour.

beta1 <- coefficients(fit)[2]

beta1## x

## 2.034375The a point estimate of the change in mean hardness when X increases by 1 hour is the coefficient of \(x\), i.e. \(\beta_1\). Hence, the value is \(2.034375\).

2. Problem 1.42abc

a. Likelihood function

The formula of the likelihood function is as follows: \[ L(\beta_0, \beta_1, \sigma^2) =\displaystyle\Pi_{i=1}^n \frac{1}{(2\pi\sigma^2)^\frac{1}{2}}\exp\left[-\frac{1}{2\sigma^2}(Y_i-\beta_0-\beta_1X_i)^2\right]. \]

Likelihood function

Since \(\beta_0=0\) and \(\sigma^2 =16\), the likelihood function is as follows: \[ L(\beta_1) =\displaystyle\Pi_{i=1}^6 \frac{1}{(32\pi)^\frac{1}{2}}\exp\left[-\frac{1}{32}(Y_i-\beta_1X_i)^2\right]. \]

b. Likelihood function

Load data

data142 <- read.table("./data/CH01PR42.txt", col.names = c("y", "x"))

attach(data142)

#head(data142)L <- function(beta1,y,x,sigma2){

diff = y-beta1*x

temp = 1/((2*pi*sigma2)^(1/2))*exp(-1/(2*sigma2)*diff^2)

result = prod(temp,1)

return(result)

}

L(17,y,x,16)## [1] 9.45133e-30L(18,y,x,16)## [1] 2.649043e-07L(19,y,x,16)## [1] 3.047285e-37The values of the likelihood function

Hence, the value of the likelihood function for \(\beta_1 =17\) is \(9.4513295\times 10^{-30}\), the value of the likelihood function for \(\beta_1 =18\) is \(2.6490426\times 10^{-7}\) and the value of the likelihood function for \(\beta_1 =19\) is \(3.0472851\times 10^{-37}\). Compared those values, when \(\beta =18\), the likelihood function has the largest value.

c. the value of the estimator

estimator <- function(y,x){

result = sum(x*y)/sum(x^2)

return(result)

}

b1= estimator(y,x)

b1## [1] 17.9285According, we get that the value of the estimator \(b_1 = 17.9284974 \approx 18\). Yes, the results in part (b) is consitent with this result, since when \(\beta =18\), the likelihood function has the largest value.

3. Problem 2.42abc

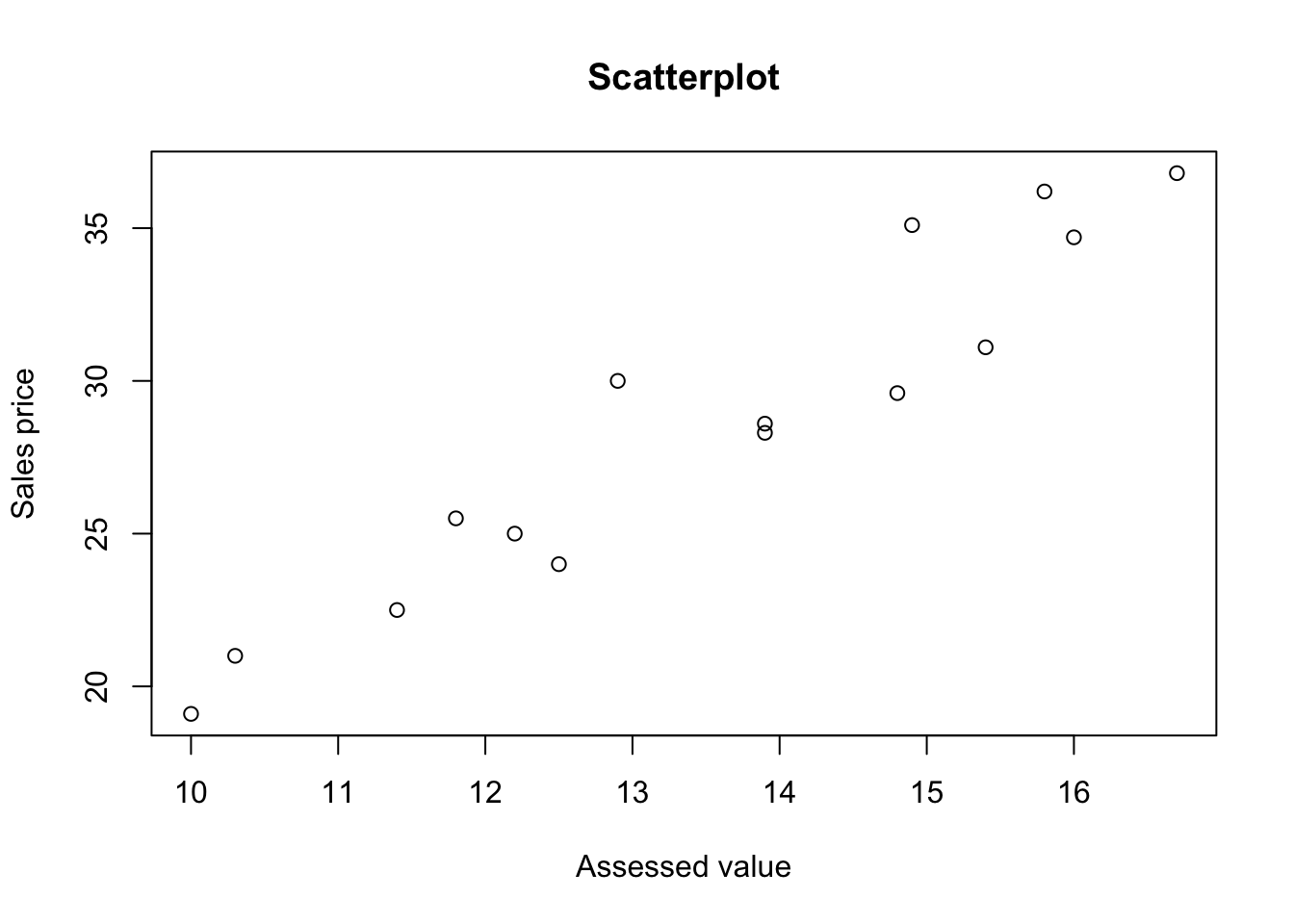

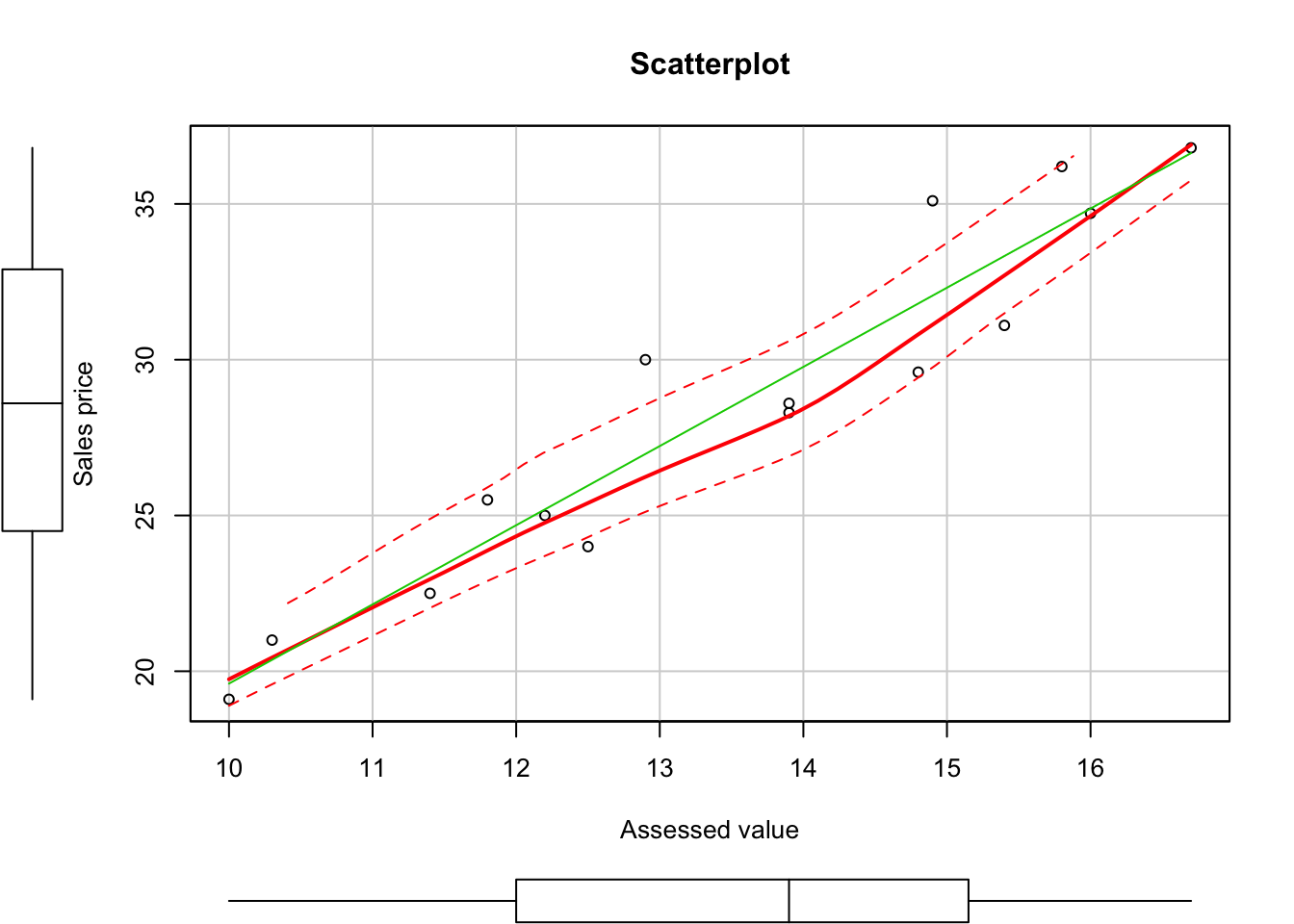

a. Scatter plot

- Load data

library(car)

data242 <- read.table("./data/CH02PR42.txt", col.names = c("y1", "y2"))

attach(data242)

#head(data242)

plot(y2~y1, data=data242,main="Scatterplot", xlab = "Assessed value", ylab = "Sales price")

scatterplot(y1,y2, main="Scatterplot", xlab = "Assessed value", ylab = "Sales price")

- Test bivariate normal distribution

library("MVN")## sROC 0.1-2 loadedroystonTest(data242)## Royston's Multivariate Normality Test

## ---------------------------------------------

## data : data242

##

## H : 0.2719501

## p-value : 0.7044176

##

## Result : Data are multivariate normal.

## ---------------------------------------------From the above test results, we can conclude that the bicariate normal model appear to be appropriate here. Since \(y_1\) and \(y_2\) are bivariate normal.

b. Calculate \(r_{12}\)

r12 <- function(x,y){

tmp1 = x-mean(x)

tmp2 = y-mean(y)

result = sum(tmp1*tmp2)/(sum(tmp1^2*sum(tmp2^2)))^0.5

return(result)

}

r12 = r12(y1,y2)

r12## [1] 0.9528469Hence the maximum likelihood estimator \(r_{12} = 0.9528469\). And \(r_{12}\) represents the point estimator of \(\rho_{12}\).

c. Test the statistically independent in the population

When the population is bivariate normal, it is frequently desired to test where the coefficient of correlation is zero:

Hypothesis

- \[ H_0 : \rho_{12} =0 ~\text{(there is no association between $y_1$ and $y_2)$}\]

- \[ H_\alpha : \rho_{12} \neq 0 ~\text{(there is an association between $y_1$ and $y_2$)}\]

The value of \(t^*\)

tstar <- function(r12, n){

result = r12*sqrt(n-2)/sqrt(1-r12^2)

return(result)

}

n =length(data242[,1])

tstarValue =tstar(r12,n)

tstarValue## [1] 11.32154\[ t^* =\frac{r_{12}\sqrt{n-2}}{\sqrt{1-r_{12}^2}} = 11.3215426\]

t_c <- qt((1-0.01/2), 15-2)

t_c## [1] 3.012276The appropriate decision rule to control the Type I error at \(\alpha\) level:

- If \(|t^*|\leq t(1-\alpha/2;n-2) = 3.0122758\) conclude \(H_0\)

- If \(|t^*|> t(1-\alpha/2;n-2) = 3.0122758\) conclude \(H_\alpha\)

Since \(t^* = 11.3215426> 3.0122758\), we conclude that \(H_\alpha\), i.e. \(y_1\) and \(y_2\) are not independent and there is an association between \(y_1\) and \(y_2\).